- St. Petersburg, FL 33702

- 727-513-3779

- contact@financialrecourse.com

Menu

Do you realize that if you owe $5,600 on a credit card with a 18% interest rate, and you only make $100 payment each month that you will owe on this account for 124 months and pay a total of $6,708.54 in principle and and paying % 54.5031 of interest for the payment?

Real examples are usually the best tool to demonstrate a theory. Let’s take few examples:

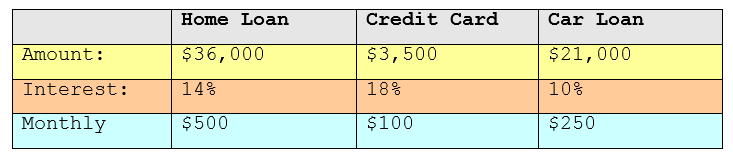

You have 3 debts:

Home loan has an amount of $36.000 with %14 of interest rate, $3500 for the credit card with %18 of interest and $21.000 for the car loan with %10 of interest.

Most people unfortunately, do not summarize their debts correctly. They simply follow the debt period/time and payoff their debts without having a clear status of what is really happening behind the scene.

As an advice, take your calculator, have a paper and do at the same time these examples and you will notice how drastically you can cut down your interests and save time and money!

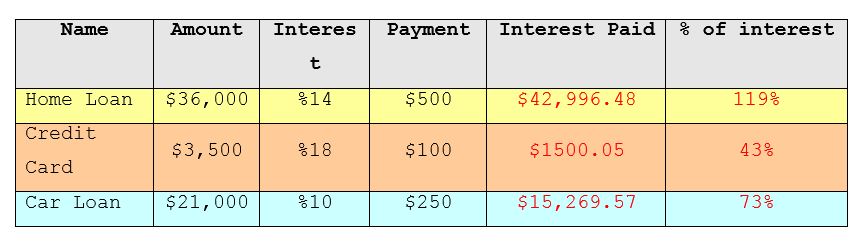

Summary for your current debts:

If you continue to make the current minimum payments on all your debts, you will be in debt for: 13 years and 2 months

During this time you will pay a total of $59,766.10 in interest which is 98.7% of your current debt!

Can you imagine this huge number! 98.7% of interest!!!

This is the current debt status; this is the nightmare if you do not follow a debt free plan. Shocking numbers!

Total: $60.500

Interest: $59.766.10

Can you imagine paying interest approximately the same amount of owe? Unbelievable!

You will be paying for this $120.266, by simply recreating a repayment plan (following steps of Chapter 5), you will save this money! And save time too! And make life easier and let the dream come true!

f you were to pay off your debts by paying either the minimum amount or the payment amount of a 15 year amortization, you would have to pay a total of $59,766.10 in interest and would not pay off your debts for 13 years and 2 months.

LEGAL PAGES

CONTACT INFO

Copyright © 2025 Financial Recourse. All rights reserved.